Compound Interest Formula in Excel

What's compound interest and what's the formula for compound interest in Excel? This example gives you the answers to these questions.

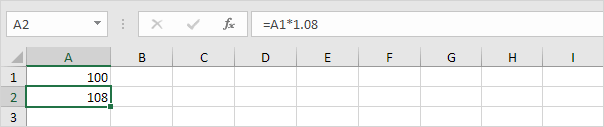

1. Assume you put $100 into a bank. How much will your investment be worth after 1 year at an annual interest rate of 8%? The answer is $108.

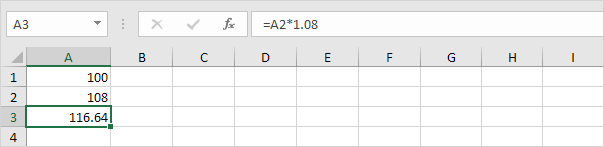

2. Now this interest ($8) will also earn interest (compound interest) next year. How much will your investment be worth after 2 years at an annual interest rate of 8%? The answer is $116.64.

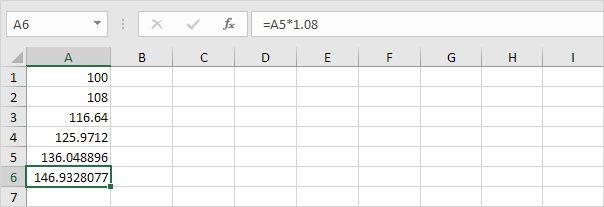

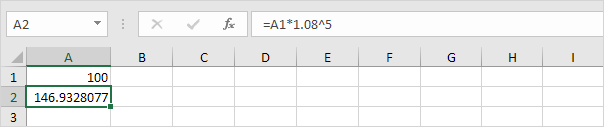

3. How much will your investment be worth after 5 years? Simply drag the formula down to cell A6.

The answer is $146.93.

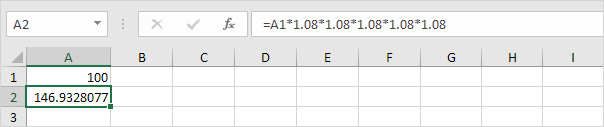

4. All we did was multiplying 100 by 1.08, 5 times. So we can also directly calculate the value of the investment after 5 years.

which is the same as:

Note: there is no special function for compound interest in Excel. However, you can easily create a compound interest calculator to compare different rates and different durations.

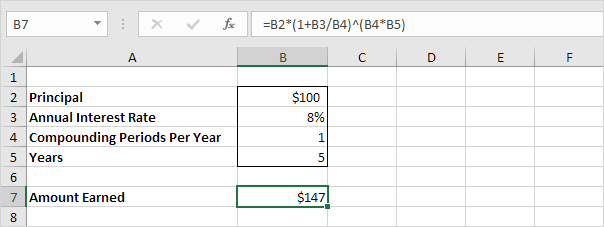

5. Assume you put $100 into a bank. How much will your investment be worth after 5 years at an annual interest rate of 8%? You already know the answer.

Note: the compound interest formula reduces to =100*(1+0.08/1)^(1*5), =100*(1.08)^5

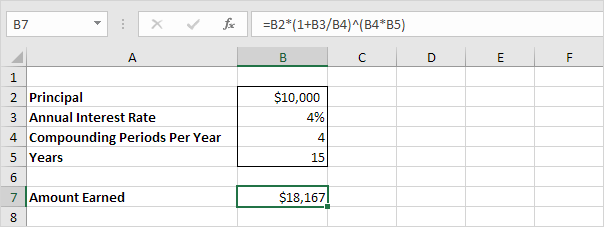

6. Assume you put $10,000 into a bank. How much will your investment be worth after 15 years at an annual interest rate of 4% compounded quarterly? The answer is $18,167.

Note: the compound interest formula reduces to =10000*(1+0.04/4)^(4*15), =10000*(1.01)^60

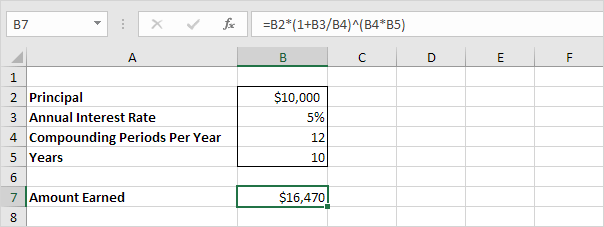

7. Assume you put $10,000 into a bank. How much will your investment be worth after 10 years at an annual interest rate of 5% compounded monthly? The answer is $16,470.

Note: the compound interest formula always works. If you're interested, download the Excel file and try it yourself!